Introduction

VERI*FACTU is a fiscal initiative by the Spanish Tax Agency (AEAT) that requires businesses to report invoices through certified software. The system generates unique identifiers for each invoice and creates digitally signed XML files that are submitted to the tax authorities.Prerequisites

To register a supplier and issue invoices, you need:- Supplier details:

- Company name

- Spanish tax ID (NIF)

- For B2B sales, customer details including:

- Tax ID (for Spanish/EU entities)

- Invoice line items with:

- Price

- VAT rates

Setup

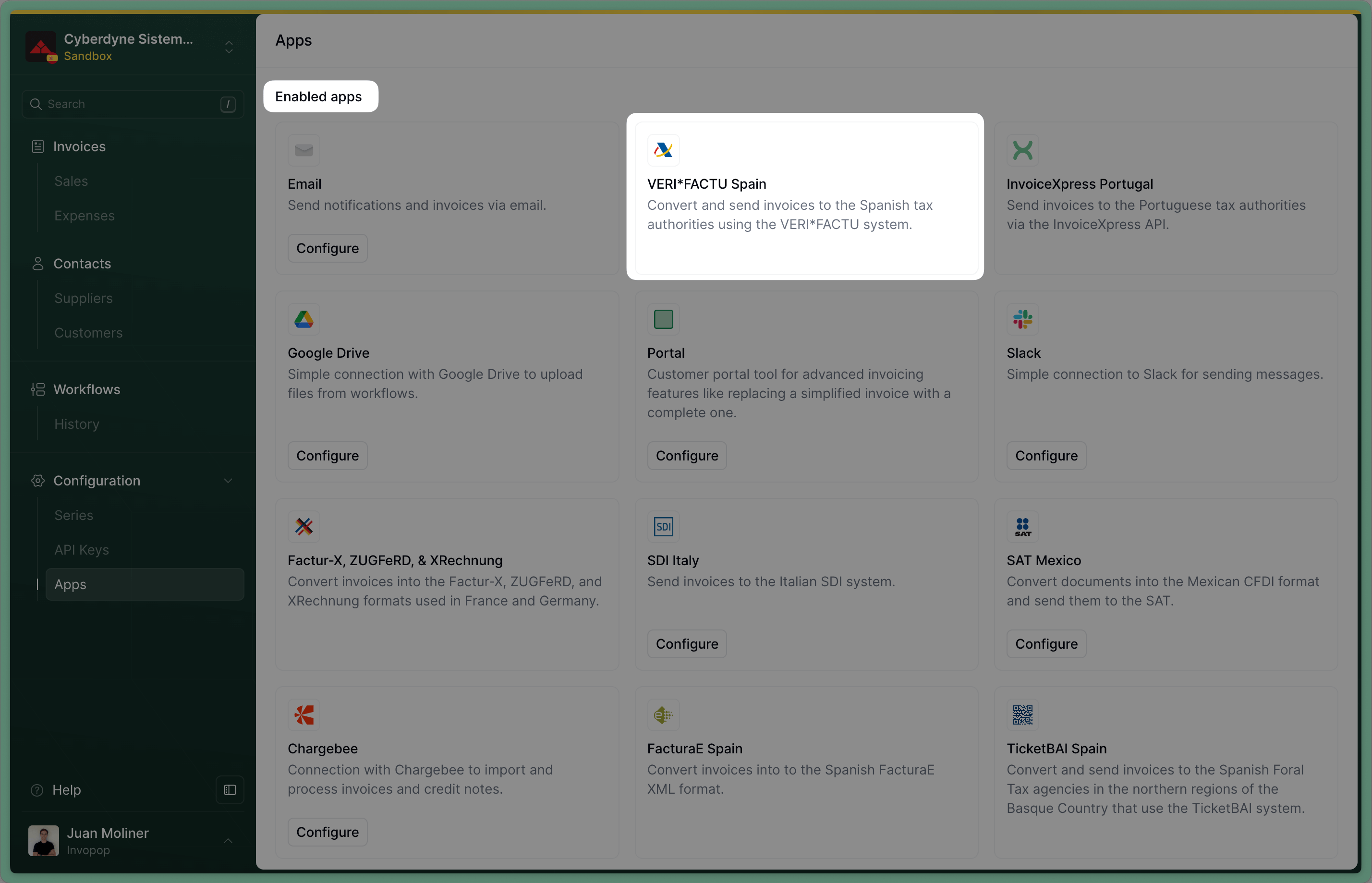

Configure your Invopop Workspace for VERI*FACTU invoicing by following these steps:Connect the VERI*FACTU app

- Go to Configuration → Apps in the Console.

- Find VERI*FACTU Spain in the app list.

- Click Connect to activate the app.

Configure the Supplier Registration Workflow

- Template

- Code

- Build from scratch

Workflow ID at hand, you’ll use it later.Configure invoice workflow

- Template

- Code

- Build from scratch

Workflow ID at hand, you’ll use it later.Running

Learn how to register a business entity (supplier) and issue VERI*FACTU invoices:Register a Supplier

Invopop has a collaboration agreement with the Spanish tax agency (AEAT) that lets us issue invoices on behalf of any entity using our certificate. This eliminates the need for you to request the entity’s certificate. However, we need the supplier to provide the following documents:- An agreement where the entity allows Invopop to submit invoices to AEAT on its behalf

- A copy of signatory’s fiscal ID (DNI/NIE)

- Documentation proving that signatory is authorized to represent the entity, such as extract from commercial registry, company bylaws or power of attorney

Upload a Supplier

-

name -

tax_id -

address -

emailExample supplier

VeriFactu supplier example

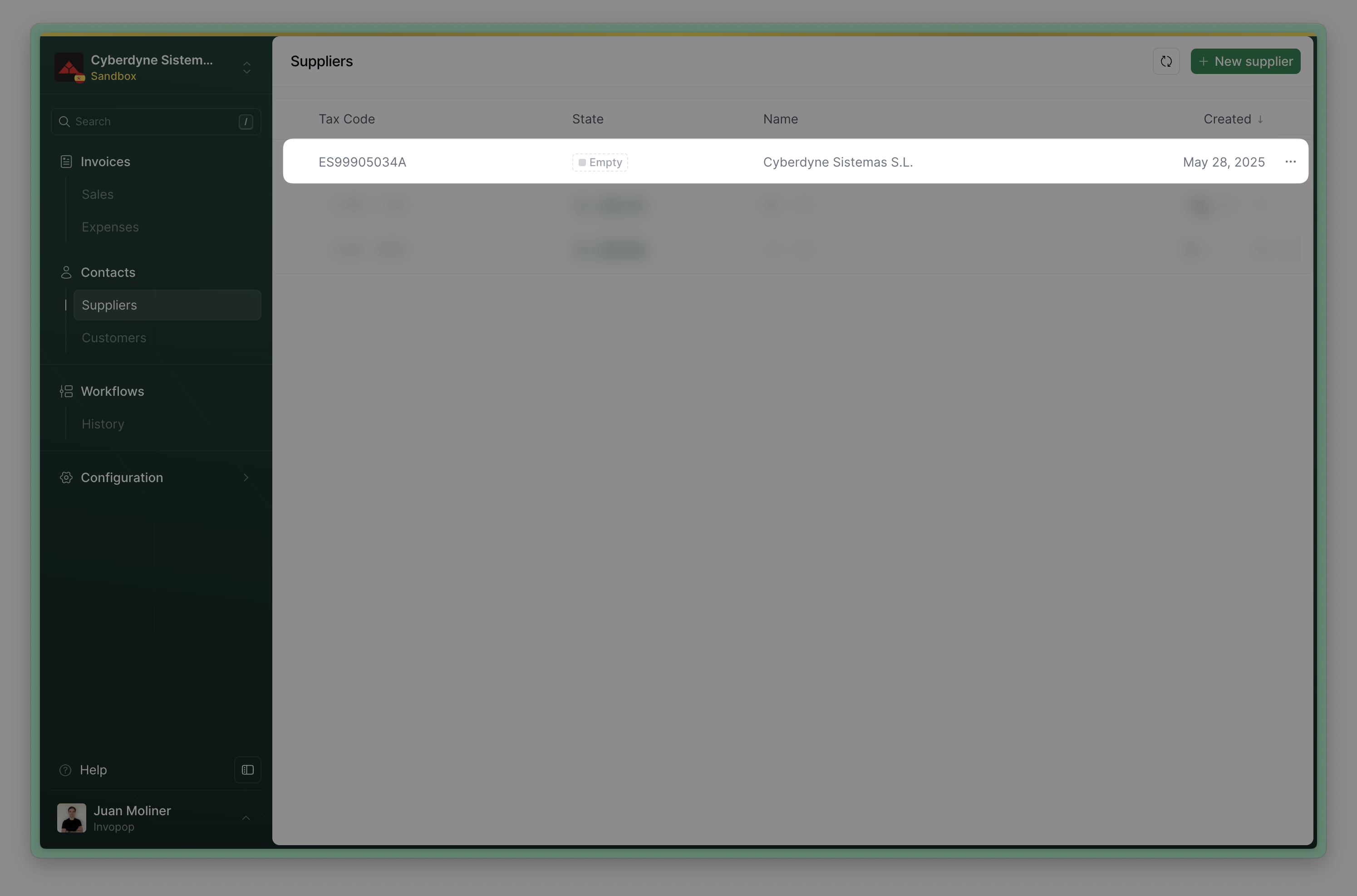

Empty.

Send the Supplier to the registration workflow

- The

Silo Entry IDof the supplier you uploaded on the previous step - The Supplier Registration

Workflow IDfrom the Setup section

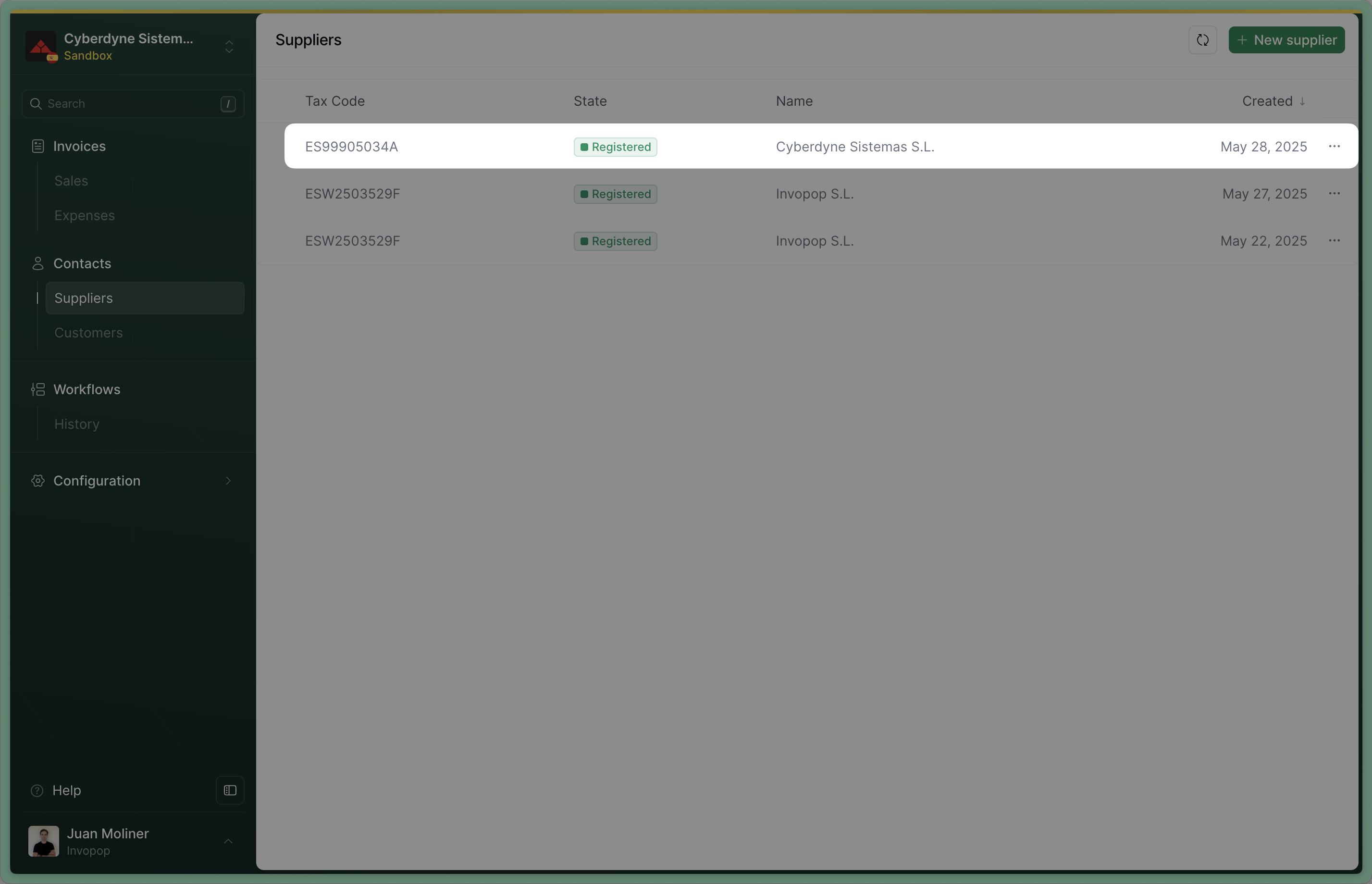

Registered when the workflow completes successfully.

Issue an Invoice

Upload an Invoice

regime:ES- Add the

es-verifactu-v1addon supplier: Use the details of the supplier you’ve registered before.

B2C Standard Invoice

B2C Standard Invoice

B2B Standard Invoice

B2B Standard Invoice

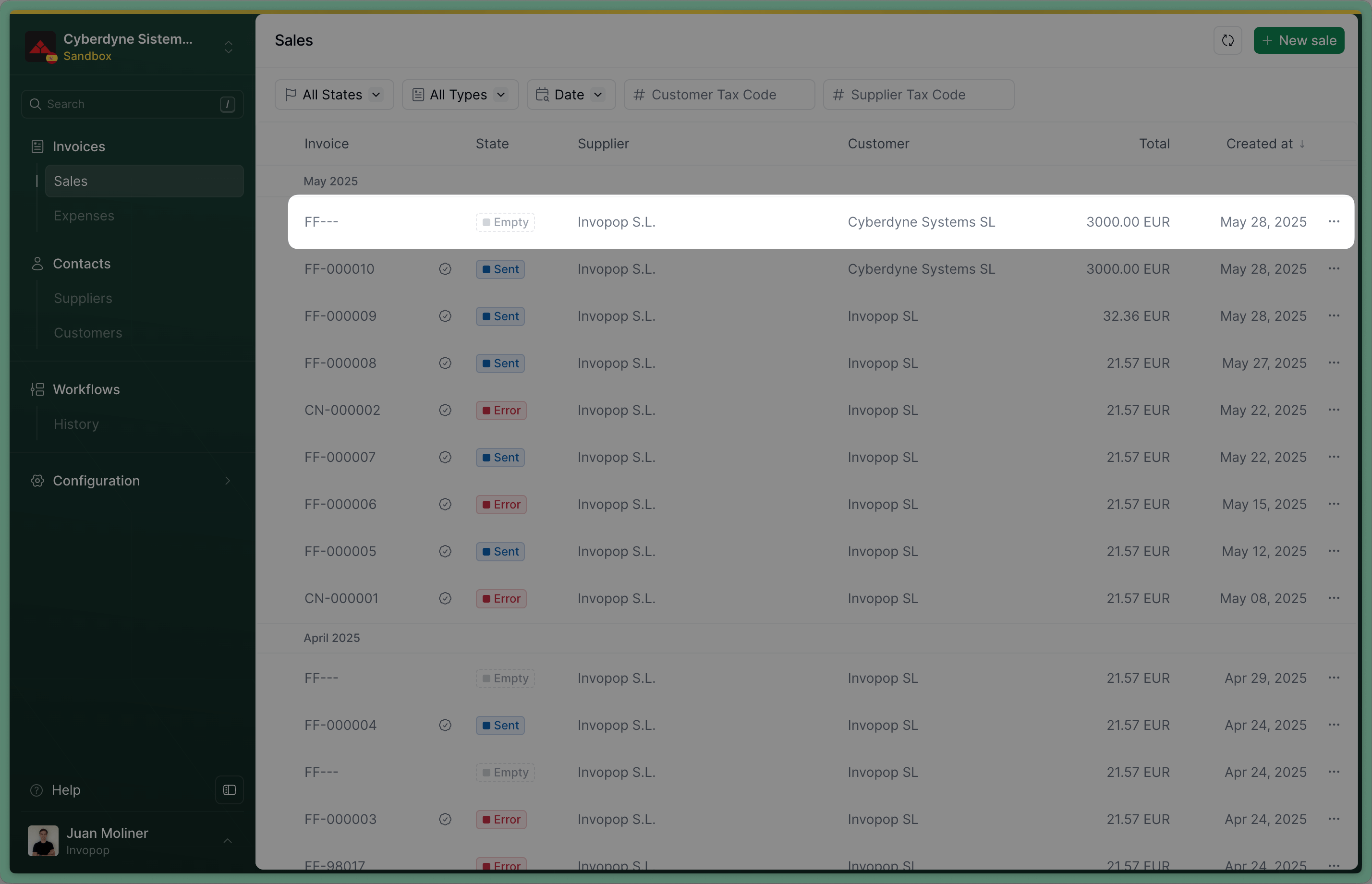

Empty.

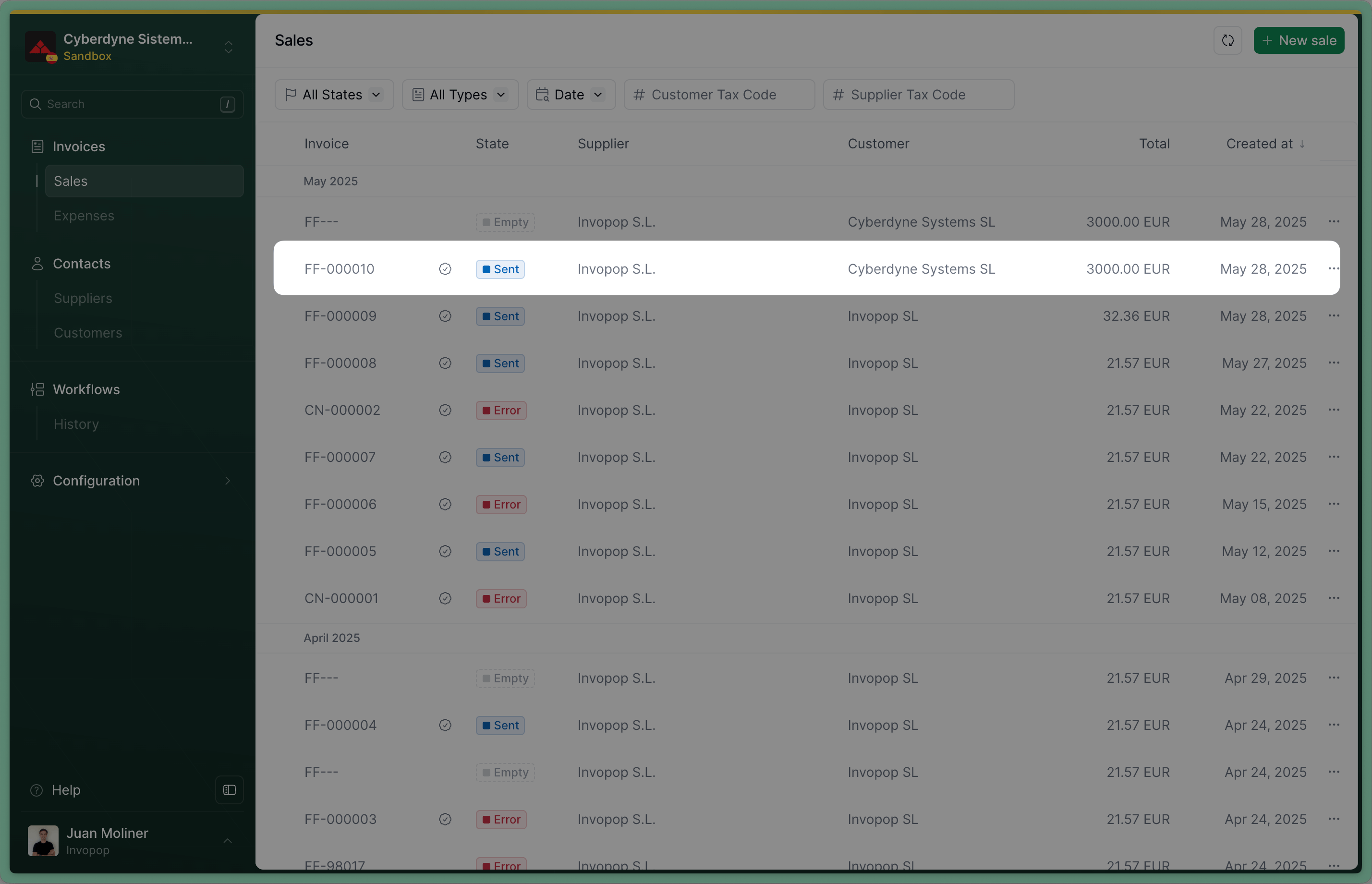

Send the Invoice to the VERI*FACTU invoice workflow

workflow_id: use the Workflow ID of the _VERI*FACTU invoice: workflow we created during setupsilo_entry_id: use the The Silo Entry ID of the invoice you’ve just uploaded.

Sent when the workflow completes successfully.

Issue a Credit Note (Rectificativa por Diferencias)

In Spain, one way to correct an invoice is by issuing a credit note, known as a Rectificativa por Diferencias. An alternative method is to issue a Rectificativa por Sustitución, which involves creating a new invoice with the type corrective. The difference between the two is subtle but important:- A credit note adjusts the value of the original invoice.

- A corrective invoice replaces the original invoice entirely.

- Issue a credit note for €20, or

- Issue a corrective invoice for €80.

Upload a Credit Note

regime:ES- Add the

es-verifactu-v1addon supplier: use the same supplier details as in the original invoicetype:credit-notepreceding: references the original invoice, within it, you must include:uuid: the UUID of the original invoice (optional but recommended)type: type of the original invoiceissue_date: the date of the original invoiceseries: the series of the original invoicecode: the code of the original invoice

Credit Note

Credit Note

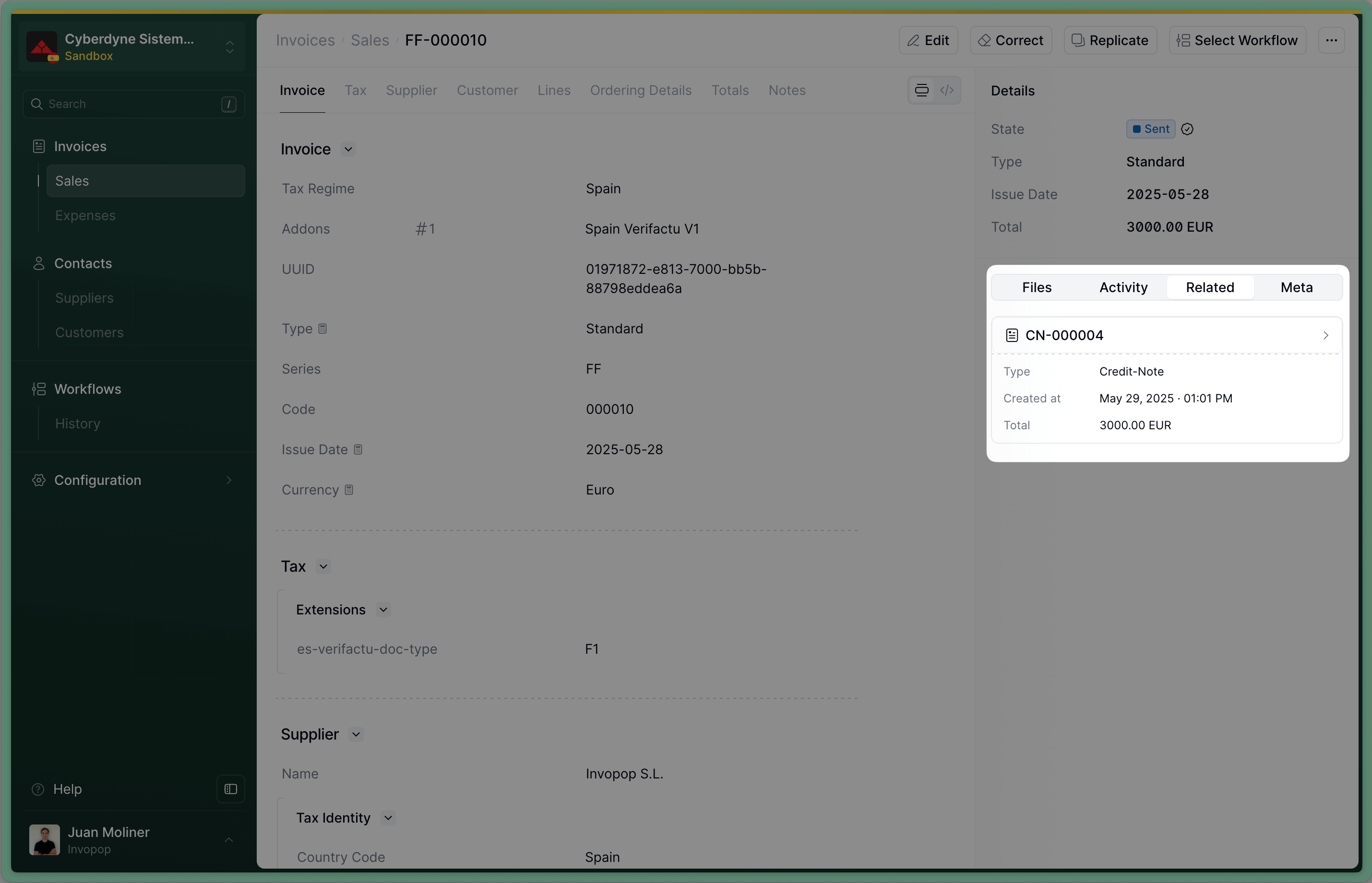

Empty. If you’ve included the uuid of the invoice in preceding, you’ll see a link to the credit note we’ve just created in the Related tab of the invoice.

Send the Credit Note to the VERI*FACTU invoice workflow

workflow_id: use the Workflow ID of the _VERI*FACTU invoice _workflow we created during setupsilo_entry_id: use the The Silo Entry ID of the credit note you’ve just uploaded.

Sent when the workflow completes successfully.Issue a Corrective Invoice (Rectificativa por Sustitución)

Upload a Corrective Invoice

corrective. So the process is very similar to uploading an invoice. Use the Create an entry endpoint to upload a corrective invoice. Include an invoice object in the data, with these required fields:regime:ES- Add the

es-verifactu-v1addon supplier_id: use the same supplier details as in the original invoicetype:correctivepreceding: references the original invoice, within it, you must include:uuid: the UUID of the original invoice (optional but recommended)type: type of the original invoiceissue_date: the date of the original invoiceseries: the series of the original invoicecode: the code of the original invoicetax: the tax section of the original invoice, you can copy it from the original invoice

Corrective Invoice

Corrective Invoice

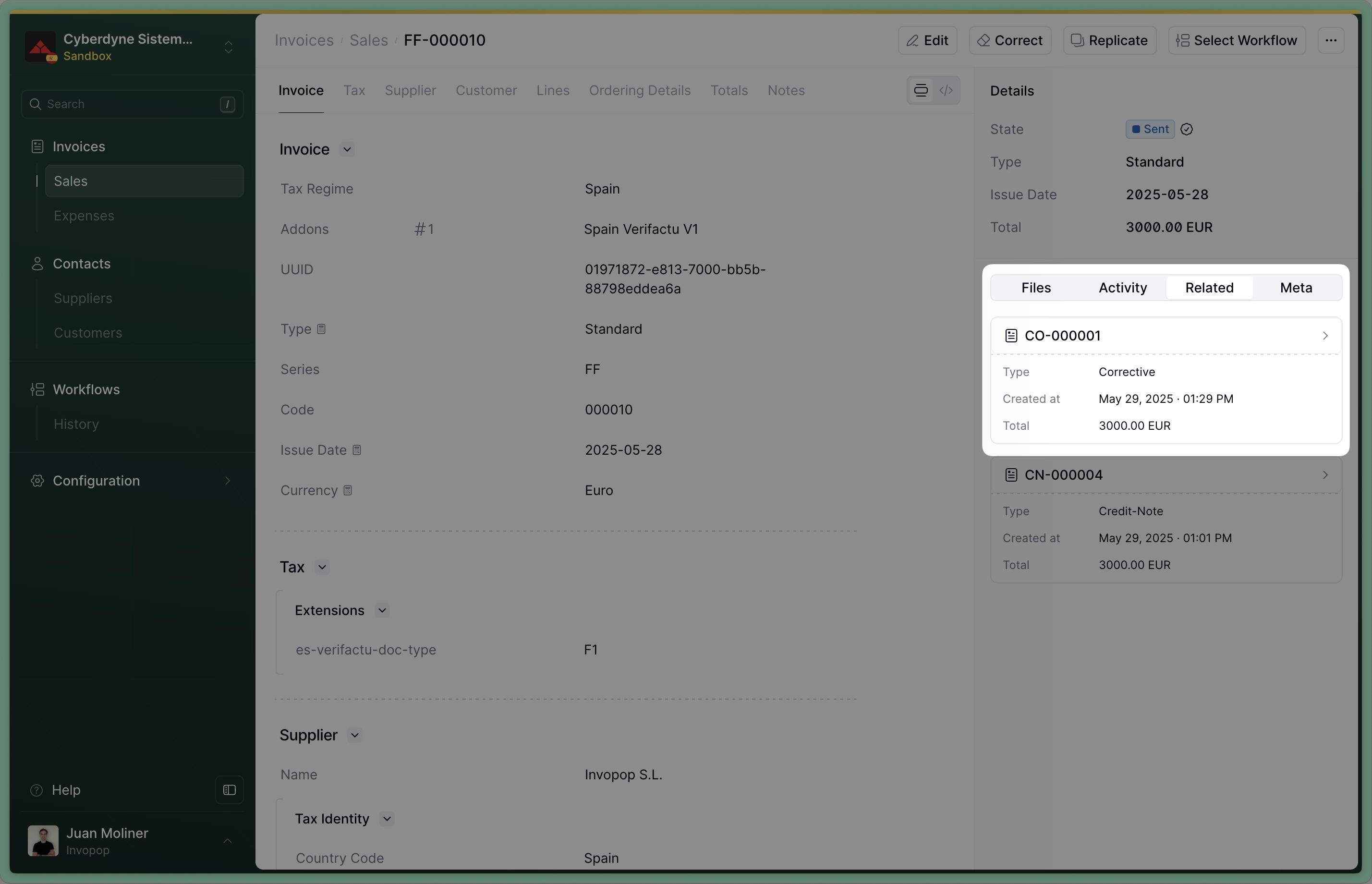

Empty. If you’ve included the uuid of the invoice in preceding, you’ll see a link to the corrective invoice we’ve just created in the Related tab of the invoice.

Send the Corrective Invoice to the VERI*FACTU invoice workflow

workflow_id: use the Workflow ID of the VERI*FACTU invoice workflow we created during setupsilo_entry_id: use the The Silo Entry ID of the corrective invoice you’ve just uploaded.

Sent when the workflow completes successfully.Cancel an Invoice

VERI*FACTU also allows you to cancel an invoice. In general, you should only cancel an invoice if it hasn’t been handed to the customer nor accepted by the tax authority. Different from a credit note or a corrective, canceling an invoice doesn’t produce a second document, which means you don’t have a paper to hand to your customer to show the cancellation. That’s why, if the invoice has been handed to the customer, we recommend issuing a credit note instead.Add a cancel invoice workflow (only once)

- Template

- Code

- Build from scratch

Send to cancellation workflow

Void when the workflow completes successfully.FAQ

Is VERI*FACTU compliance mandatory in Spain?

Is VERI*FACTU compliance mandatory in Spain?

How can I correct an invoice?

How can I correct an invoice?

- The recommended approach is to issue a GOBL Invoice with the type

credit-noteordebit-note, which in VERI*FACTU translates to a “Factura Rectificativa por Diferencias”. - If the above approach does not apply, you can issue an invoice of type

corrective, which in VERI*FACTU translates to a “Factura Rectificativa por Sustitución”. - Lastly, you can use the

Cancel VERI\*FACTU (Spain)step, which will void the invoice in the tax authority. This should only be used under special circumstances and not as part of a regular workflow.

What should I do if an invoice is rejected by VERI*FACTU?

What should I do if an invoice is rejected by VERI*FACTU?

What is the VERI*FACTU chain?

What is the VERI*FACTU chain?